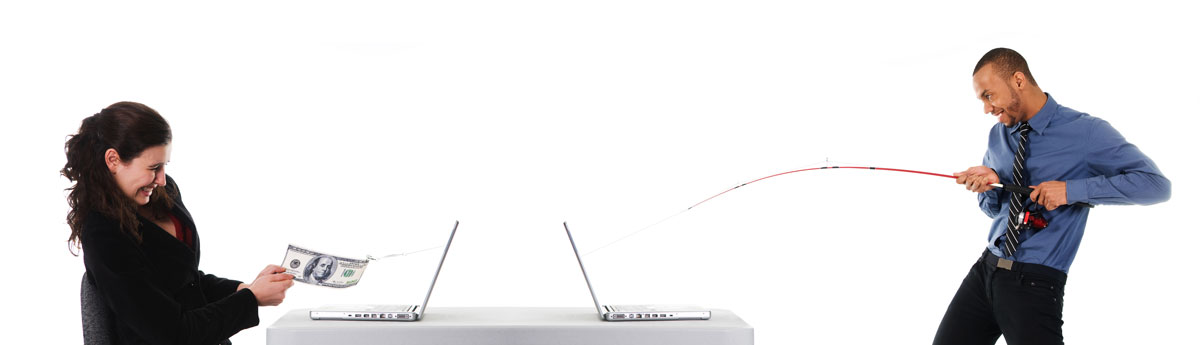

Lessons in Detecting Fraud

There has been a tremendous increase in fraudulent check schemes involving attorneys and their escrow accounts. Our firm has been the target of at least 3 scam attempts this year alone.

The cases involve a person, who appears to be a legitimate client, attempting to use the attorney-client relationship and the attorney escrow account to steal money. My office has represented a number of attorneys who have been the victims of these kinds of scams. In hindsight, there were signs that should have set off alarms to the lawyers warning them of the strong possibility that these clients were not legitimate.

In this article, I will share my experience with a scam attempt that targeted my firm in hopes that more attorneys learn how to detect fraudulent cases.

The Story of Roy Whitman

The scams usually begin with an unsolicited email asking if the attorney handles the type of law that is represented in the email. In our case, Roy Whitman, a very wealthy Texas oilman, contacted me and wanted to know if I could represent him in the sale of oil well equipment in Southern Illinois.

Although we were suspicious that this was a scam, we responded to the email to see what the latest fashion was in material misrepresentation so that I could share the experience with other attorneys.

Roy asked us what our fee schedule was, and said that he was willing to pay on an hourly basis. The prospective oil equipment had a sale price of $2.3 million. The anticipated transaction expense was $10,000. Roy said he would like to have the purchaser pay the fee since they already owed an earnest money deposit of $230,000 as part of the transaction.

Most of these cases involve contingency fee agreements, wherein a check is sent to the attorney, is deposited into the escrow account, and the funds are wire transferred out. We said we would not accept any checks, especially out of state checks or out of country checks; we would only accept direct wire transfers. This was our attempt to see how far we could push this Texas oilman.

Lo and behold, the next week Roy wire transferred $230,000 to our account – an account we set up just for this transfer. Suspecting a scam, I contacted my bank and asked them if they could confirm that the wire transfer was from actual funds. After some investigation, the bank found that the wire funds were transferred as a result of a check that was deposited into an account in Nebraska and that the check was in fact fraudulent.

I contacted Roy to tell him that the bank had rejected the wire transfer because the funds could not be confirmed, but Roy was not deterred. He next offered to send a cashier’s check from the seller so that we could have that check deposited into our escrow account, keep our fee, and wire the remainder to him. This is more like the classic fraud that we had seen victimizing other attorneys as part of our practice.

3 days later by FedEx, we received a certified cashier’s check drawn out of a bank in Canada. This check appeared to be legitimate – it was drawn on check paper, it had the appropriate watermark, and it was considered clear funds at the time it was deposited into the escrow account. But because this check was from our friend Roy, we suspected that it would also be found to be illegitimate.

After numerous panicky calls from Roy asking, requesting, and then demanding that we wire transfer the balance of the cashier’s check to his account, within three business days, the check was deemed to be NSF (indicating non-sufficient funds) and was returned to the bank in Canada.

I contacted Roy and told him that, to my shocking surprise, the check had bounced. That was the last I heard of Roy.

Lessons Learned

The lesson from this story is threefold.

1. Unsolicited emails, like unicorns, are usually not real and are the precursor to a scam 9 out of 10 times.

2. Any time that you receive a wire transfer from a new client, a new source, or unverifiable source, you should wait at least 5 business days to confirm the source of the funds.

3. If you believe that you are receiving monies that may be illegitimate or uncollectable, you should set up a separate independent account at your bank (even a temporary one) so as to not commingle any of these monies with the firm escrow account.

The risk of financial disaster is extremely high if your firm is a victim of one of these scams.

First, any loss of an escrow account is a violation of your ethical duties to your other clients who have funds in that account. The loss of monies from an escrow account is not only a violation of an attorney’s fiduciary duty, but it can and will result in an ARDC investigation for the loss of client funds. Second, these kinds of transactions are not covered under any professional negligence policy. Since it is a financial transaction and not legal transaction, it is exuded.

The old adage “if it is too good to be true, it probably is” absolutely applies here.